Vendor Summary Reports examine recent quarterly results and items of interest about key vendors in the optical market. Occasionally we also write in-depth profiles of smaller companies that we think are interesting.

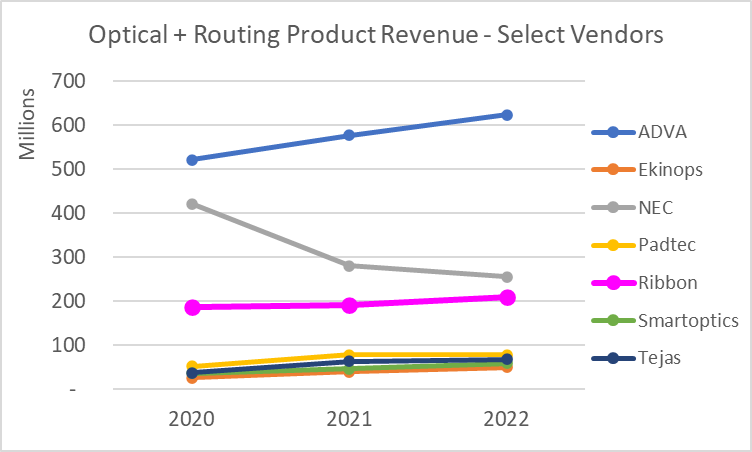

At first glance, one might see Ribbon as the largest of the small routing/optical vendors. With annual optical and routing product revenue of $218M, Ribbon’s sales are at the high end of its peers. But upon a closer look, it is more accurate to describe Ribbon as the smallest of the large vendors. With total company revenue approaching $1B, combined with geographical and portfolio breadth and deep relationships (and wins) with Tier 1 operators, Ribbon makes a good case that it is a genuine challenger to the top vendors in the industry.

Company Background

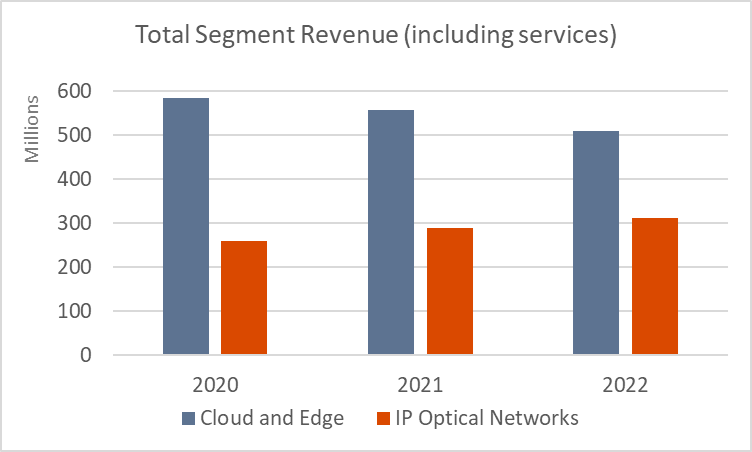

Ribbon was formed in 2017 from the combination of Genband and Sonus Networks. Both companies were founded in the telecom heyday of the late nineties to capitalize on the modernization of the carrier voice network, and specialized in media gateways and session border controllers. Ribbon categorizes these products as its “Cloud and Edge” portfolio, representing about 60% of total company revenue. Seeking growth to offset the flat-to-declining voice business, Ribbon acquired ECI in 2020 and secured a complementary product line well-positioned for anticipated 5G and broadband buildouts.

Founded as the Electronics Corporation of Israel, ECI was a mainstay in the data and optical transport market for over 50 years. At the time of acquisition, the company had approximately 1,700 employees. Ribbon refers to the collection of products from ECI as “IP Optical Networks” and markets the solution under the name “IP Wave.” There is little technological linkage between the two halves of Ribbon’s business, but they have an overlapping customer base and complementary geographical focus (Cloud and Edge is strongest in NA, whereas IP Optical has historically been successful in Europe, India, and Southeast Asia). A unified sales force brings the potential for cross-selling and gaining a foot in the door at Tier 1’s, where Ribbon’s voice solutions are widely deployed. The combination is already showing results. While the IP Optical division delivers gross margins roughly half that of the software-heavy Cloud and Edge portfolio, its top-line growth has been a bright spot for Ribbon over the past several years.

Clients log in to access full report